The responsibility of a liquidator is to distribute a company’s assets whilst ensuring that no creditors are being unfairly advantaged or disadvantaged. If a voidable transaction has taken place prior to the appointment of a Liquidator, then the Liquidator has the power to avoid these transactions under the Corporations Act 2001 (Cth), to ensure that assets are distributed fairly amongst creditors.

For all voidable transaction claims, the Liquidator has the later of 3 years from when first appointed as Administrator, Liquidator or the proceedings to wind-up the company are first filed (defined below as the relation-back day) or 1 year from when the Liquidator is first appointed as a liquidator to commence proceedings for a voidable transaction.

Our resources in the below Guide to Corporate Voidable Transactions will assist you with understanding the most important aspects of voidable transactions.

Unfair preferences

Unfair Preferences are the most common type of voidable transaction and occurs where a creditor has received an advantage over other creditors, by receiving payment (or other type of transaction) for their outstanding liabilities and does so in circumstances where they knew, or ought to have known, that the company was insolvent.

Uncommercial transactions

An uncommercial transaction relates to transactions entered into by a company where it may be expected that a reasonable person in the company’s circumstances would not have entered into the transaction, by having regard to its benefits and/or detriments to the company. Liquidators have the power under the Corporations Act 2001 (Cth) to void such transactions.

Unreasonable director-related transactions

Similarly, to an uncommercial transaction claim, an unreasonable director-related transaction arises when a transaction is entered into by a director or close associate of the company, in circumstances where it may be expected that a reasonable person in the company’s circumstances would not have entered into the transaction. Again, the court has regard to the benefits and/or detriments to the company by entering into the transaction. Liquidators have the power under the Corporations Act 2001 (Cth) to avoid such transactions.

The main differences between an unreasonable director-related transaction and an uncommercial transaction claim is that:

- For an unreasonable director-related transaction to arise, a director or close associate must be involved;

- The transaction does not have to have been entered into when the company was insolvent – meaning the Liquidator does not need to go to the effort of proving insolvency; and

- The relation-back period is 4 years.

Unfair loans

When an insolvent individual passes away leaving unresolved debt, it can not only be an emotionally devastating time, however it can also cause a financial burden on those involved.

An administration of deceased persons estate (Part XI under the Bankruptcy Act), allows for the realisation of assets of the deceased person in order to pay creditors for unpaid debt. SV Partners are able to address this situation with the professional advice and skills required to deal with all aspects of a deceased estate in a timely manner.

Defending voidable transactions

The main defences to a voidable transaction claim are:

- Good faith defence;

- Running account balance defence;

- The defendant creditor is a secured creditor; and

- The ultimate effect doctrine or “the landlord defence”.

Other arguments that we have faced against claims we have run are:

- Capacity to pay;

- Equitable liens;

- Set-off, following the recent case law commentary;

- Charging clauses; and

- Factoring agreements.

If you have any questions regarding these possible defences, please give our experts at SV Voidables a call on 1800 246 801.

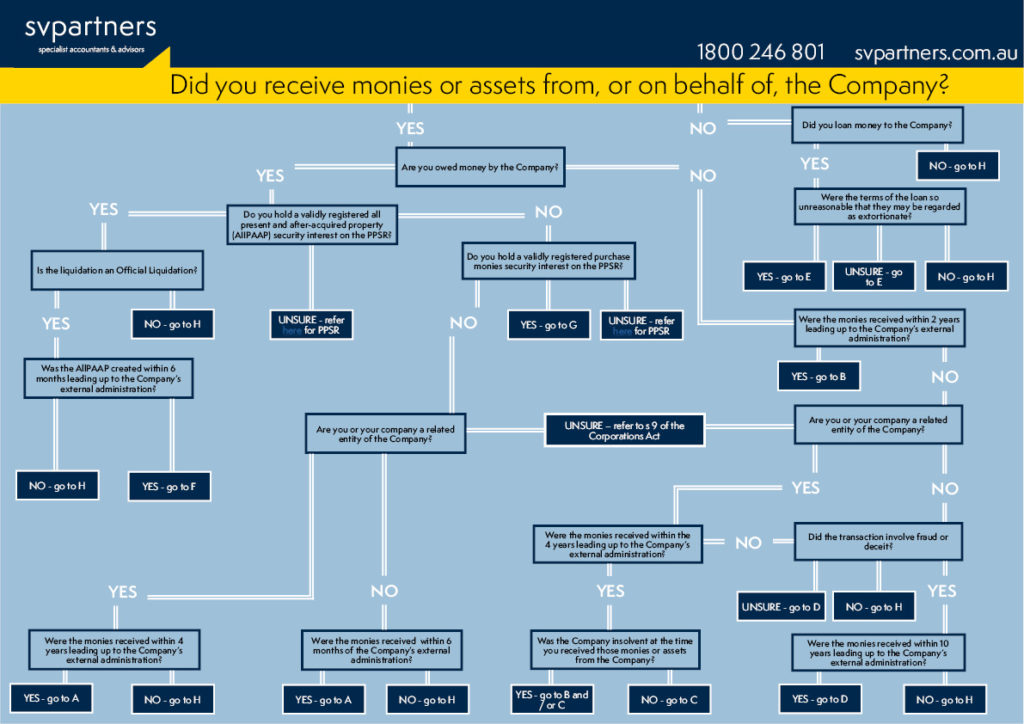

Voidables Tree Diagram

When companies go into Liquidation, Liquidators have a broad range of powers to claw-back certain types of unreasonable, uncommercial, preferential or unfair transactions that had occurred prior to their appointment. SV Voidables’ infographic provides a mind map, and brief explanation, of every type of voidable transaction available to Liquidators that all stakeholders should be aware of. If you have any questions about this mind map please contact one of our expert advisors on 1800 246 801.

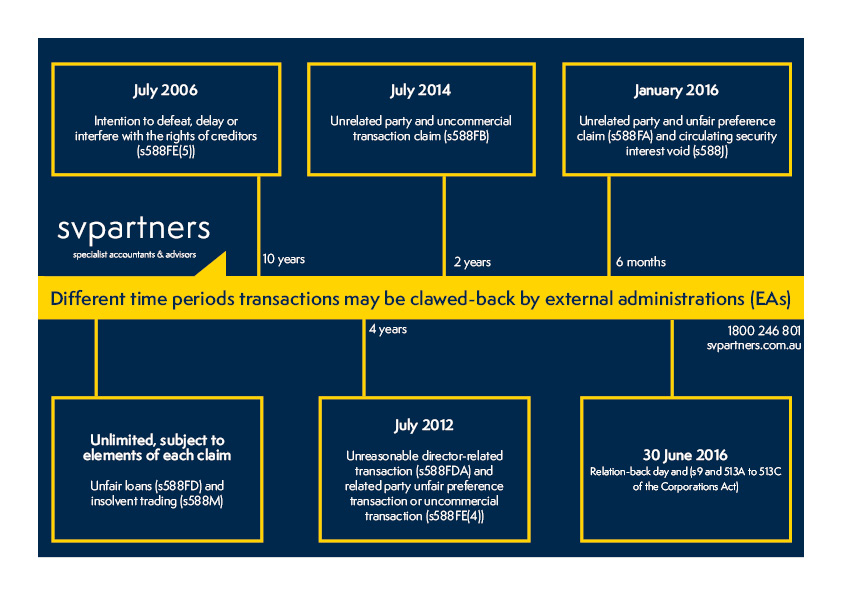

The Time Period for all Voidable Claims

Ever wondered how far back Liquidators can look to claw back voidable transactions from third parties? SV Voidables’ infographic will tell you the answer for all types of voidable transactions under the Corporations Act 2001.”

For more information, click here.

How can SV Partners help?

In order for a debtor to propose a Personal Insolvency Agreement, they must appoint a Registered Trustee, such as SV Partners. Once SV Partners is appointed, we conduct our investigations, report to creditors on your behalf and structure a proposal that is beneficial to all parties involved.

SV Partners will guide you through the process, providing support every step along the way of administering your Personal Insolvency Agreement. Our services are designed to alleviate the pressures you may be facing from creditors.

For more information about Personal Insolvency Agreements, visit our FAQ section. Alternatively, to discuss your situation and see how our team can help, contact us on our confidential assist line on 1800 246 801 for an obligation free consultation.