Small Business Restructuring (SBR) laws have been in play now under the Australian Corporations Act (Cth) 2001 since January 2021.

More recently, we were approached to advise a small business who is contemplating making an appointment of a SBR on the effect of related party claims.

Just to recap, in order to be eligible to undertake n SBR, the company must:

- Ensure all taxation lodgements are up to date and lodged;

- All employee entitlements paid up to date;

- Creditors need to be under $1,000,000; and

- The company must not have been subject to a SBR or a simplified liquidation in the last seven (7) years.

Also relevant, is that the company and the Restructuring Practitioner appointed have twenty (20) business days from appointment to devise a Restructuring Plan to be issued to creditors whereby creditors will vote to either accept or reject the plan. This is known as the Proposal Period. If a majority in value approve the Restructuring Plan, it passes. If the Restructuring fails, the company director will need to consider further options such as Liquidation or the appointment of a Voluntary Administration.

Related parties are not entitled to vote under a SBR Restructuring Plan.

Some key definitions under

CORPORATIONS REGULATIONS 2001 – REG 5.3B.01

“affected creditor” means:

a) in relation to a proposal to vary or terminate a company‘s restructuring plan–a creditor of the company who is a party (as creditor) to the plan; or

b) in relation to a proposal by a company to make a restructuring plan–a person who would be a party to the restructuring plan if it were made.

“excluded creditor” , in relation to a company under restructuring, means a creditor of the company who:

a) is the restructuring practitioner for the company; or

b) was, at the time the restructuring began, a related creditor of the company; or

c) was, on becoming an affected creditor, a related entity of the restructuring practitioner.

“related creditor” of a company means a person who is a related entity, and a creditor, of the company.

So what is a Related Entity?

Section 9 of the Act defines a related entity of a body corporate as follows;

a) a promoter of the body

b) a relative of such a promoter;

c) a relative of a spouse of such a promoter;

d) a director or member of the body or of a related body corporate;

e) a relative of such a director or member;

f) a relative of a spouse of such a director or member;

g) a body corporate that is related to the first-mentioned body;

h) a beneficiary under a trust of which the first-mentioned body is or has at any time been a trustee

i) a relative of such a beneficiary;

j) a relative of a spouse of such a beneficiary;

k) a body corporate one of whose directors is also a director of the first-mentioned body;

l) a trustee of a trust under which a person is a beneficiary, where the person is a related entity of the first-mentioned body because of any other application or applications of this definition.

Takeaways

The definition directly above outlines the broad scope and operation of who and what is defined as a related entity therefore has far reaching impact on parties who can vote under a SBR Restructuring Plan.

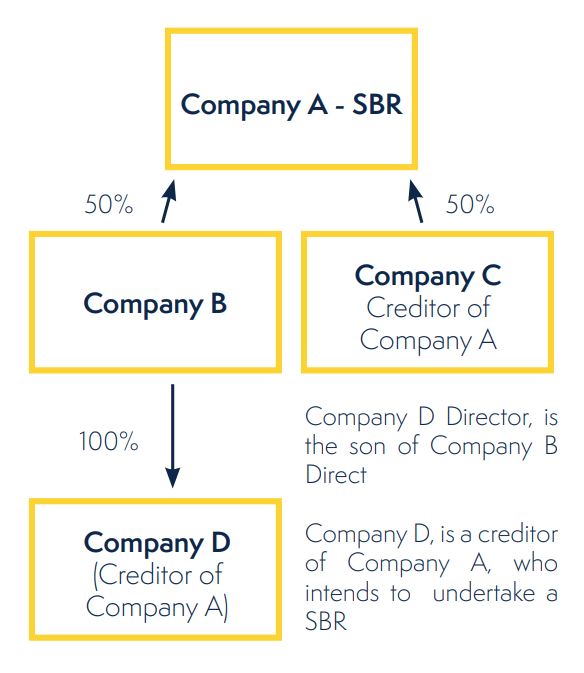

In a recent case, the structure and shareholding of the group was as follows:

- Company A was considering an SBR with its creditors;

- Company C and Company D are creditors of Company A;

- The director of Company A relied on the claim of Company D (material to affect the outcome of the Restructuring Plan by voting in favour thinking that it was not a related entity of Company A.

- Company B is related to Company A by virtue of its shareholding in Company A.

- The director of company D is the son of the director of Company B and meets the Section 9 definition above therefore those entities are considered related.

- As a result Company B & D’s relationship, Company D may also be deemed related to Company A.

- Company C would also be a related entity by virtue of its shareholding in Company A.

Key Takeaway Points on SBR’s and Related Party claims for directors and advisors:

- Clearly assess creditor claims to determine which creditors may be deemed related entities;

- Seek independent legal advice or advice from a Director at SV Partners prior to considering undertaking an SBR.

Article written by Michael Carrafa (Executive Director) – Melbourne