What is Voluntary Administration?

Voluntary Administration is a process initiated when a company faces insolvency and cannot pay its debts. It involves appointing a 'voluntary administrator', usually by the company directors, to assess options and devise the best course of action for the business and its creditors. This process aids in determining the company's future, whether it's restructuring, liquidation, or a different solution.

Insolvency can occur for a variety of reasons, from simple misfortune to poor management. When a business becomes insolvent, it’s important to deal with the issue as soon as possible.

By entering into voluntary administration, an insolvent company can access the support and advice of an independent Administrator who will help to assess the business’ financial situation and develop an appropriate strategy for moving forward.

Typically, to commence voluntary administration, the Directors of the company suspect the company is insolvent, or that it is likely to become insolvent, and can decide to appoint a Voluntary Administrator.

Rather than waiting until the business becomes unviable, voluntary administration allows the business to gain breathing room from its creditors and explore its options, including the possibility of continuing to trade. An administrator should be appointed as quickly as possible to maximise the chance the business will survive.

The Corporations Act 2001 (Cth) (the Act) provides for companies in financial difficulty in that:

- If a company experiences financial problems, the directors may appoint an administrator to take over the operations of the company. The administrator will work with creditors to try find a solution to the company’s problems.

- If the company’s creditors and the company cannot agree, the company may be wound up

- If a registered liquidator is appointed as a voluntary administrator over a company, it is the voluntary administrator whom will review and consider any proposed DOCA. The administrator must make a recommendation as to whether it’s in creditors’ interest to accept the DOCA.

- It is often the case that a DOCA is not put forward (likely resulting in liquidation). A recommendation is made in circumstances whereby creditors are likely to receive a higher return (by way of dividend) if the DOCA is accepted than if the company were to be placed in liquidation.

- Creditors are given the power to determine the future of the company. It is rare that a company is returned to its directors. In the event that creditors cannot agree or where a DOCA leaves creditors worse off than in a liquidation scenario, the company may be wound up at the second meeting of creditors.

Is Business Voluntary Administration The Right Decision?

Voluntary Administration is just one solution for businesses that are facing financial hardship or pressure from creditors. The expert team at SV Partners can assess your company’s situation and determine whether Voluntary Administration is the right solution for your business.

Common warning signs that a business is experiencing financial difficulties and may enter the voluntary administration process include:

- Ongoing losses

- Overdue taxes

- Not paying creditors within agreed terms

- Making rounded payments not against specific invoices

- Being unable to produce timely and accurate accounts

- Threats of legal action, or creditors commencing legal action for debt recovery

- Inability to obtain further finance from existing or alternative lenders

- Suppliers placing your business on cash on delivery (COD) terms, demanding payment plans or demanding payment before further supply is made

What Causes Voluntary Administration?

A company may enter into voluntary administration in a number of circumstances. This could include situations where the directors suspect that the company is insolvent or is likely to become insolvent at a future point in time.

While less common, voluntary administration may also occur where a secured creditor appoints an administrator to seek recourse. A voluntary administrator may also be appointed where:

- There are pressures from creditors demanding payment

- Company directors are at personal financial risk from insolvent trading

- There are disputes between directors or shareholders

- Legal action or events that may jeopardise the company have occurred

The Voluntary Administration Process

If your company becomes insolvent or enters receivership it’s important to act quickly. Entering into voluntary administration gives a company access to an independent Voluntary Administrator who assesses the business and helps develop a plan for moving forward.

During the voluntary administration process, unsecured creditors are prevented from continuing or commencing any claims against the company.

At the end of a voluntary administration, the company may enter into a Deed of a Company Arrangement (also known as DOCA) with its creditors. Alternatively, the administrator may recommend that the company be placed into liquidation.

There are typically three options available at the end of voluntary administration:

The administration period ends and the company trades on under the control of its directors.

The company is liquidated.

Creditors approve a Deed of Company Arrangement

What Happens When A Company Goes Into Voluntary Administration

The administration period ends and the company trades on under the control of its directors.

The company is liquidated.

Creditors approve a Deed of Company Arrangement

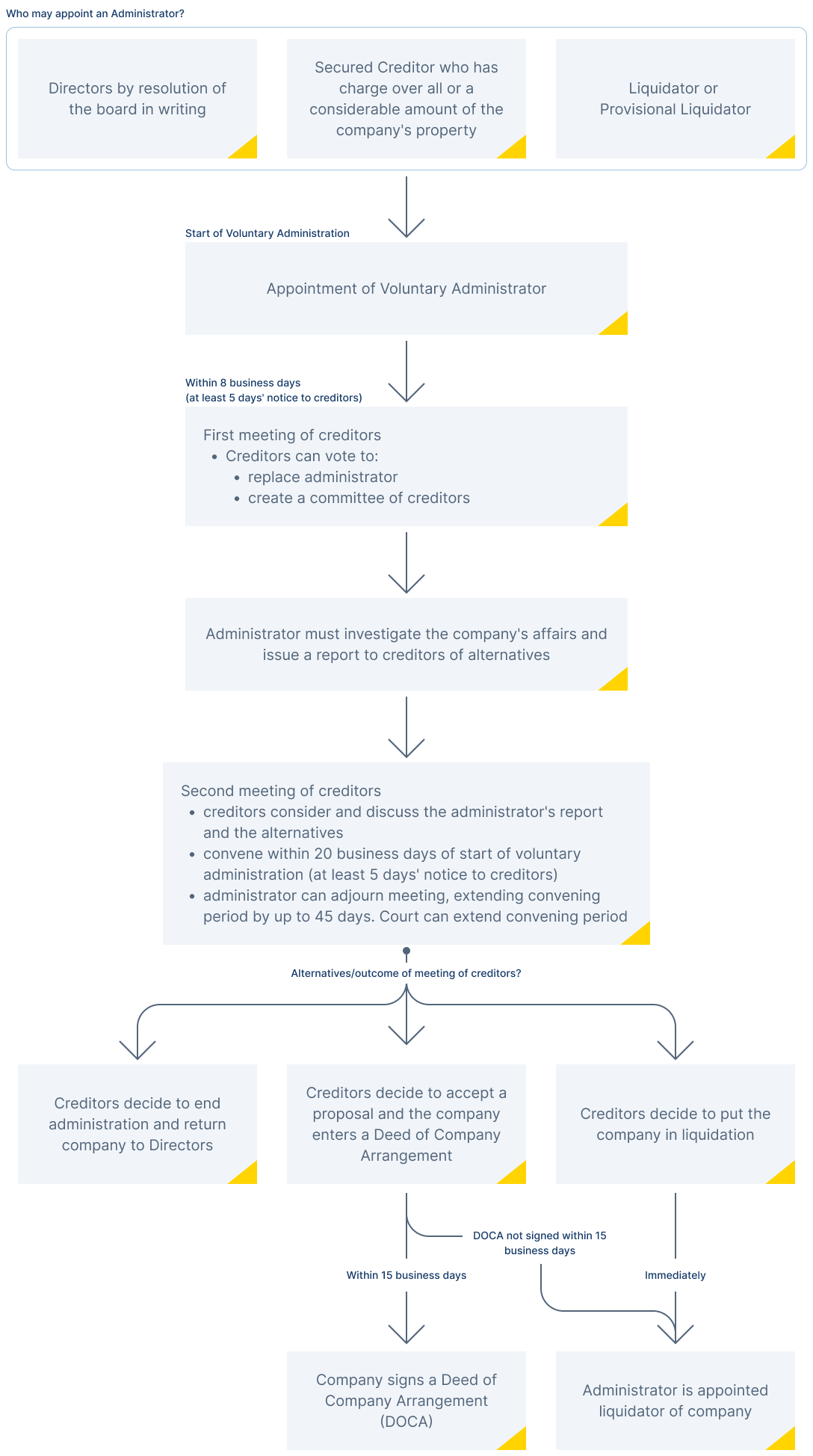

Step by Step Process of Voluntary Administration

The voluntary administration process typically lasts between 25 to 30 business days.

To initiate the process, the company will appoint an independent Administrator to assess the business. The administrator takes control of the company, investigates its operations and then reports to creditors about the company’s affairs and financial circumstances. This report is made at a creditors’ meeting, at which point creditors may be allowed an additional 15 business days to accept the administrator’s Deed of Company Arrangement (DOCA).

In some circumstances, a court may grant extensions to the initial 25 day period. A court can also extend the creditors’ 15 day period to reach a decision regarding the DOCA.

The objective of voluntary administrations is to find the best possible arrangement for everyone involved with an insolvent company. In some cases that means the business will be liquidated to allow creditors to recover their debts.

Other times though, the Voluntary Administrator may recommend a binding agreement called a Deed of Company Arrangement (DOCA).

A DOCA is an arrangement between a company and its creditors that lays out the details of how the company’s affairs should be dealt with.

DOCAs are designed to maximise the chance of the company’s survival and provide a better return to creditors than immediately winding up the business. Often, this means that creditors will accept partial payment of their debts, with the remainder being forgiven once the DOCA is complete.

The voluntary administration process is designed to help creditors recover more of the money they are owed. Rather than simply moving straight to liquidation, voluntary administration allows a company’s directors to work with financial experts to develop a plan of action.

This process involves input from creditors at two different meetings. The first meeting takes place within eight days of the start of the administration.

The second meeting is held after the administrator has completed their investigations, where creditors vote on how to proceed and whether to accept the company’s DOCA. In most cases, votes are decided by the creditors who represent the majority in number and value.

All secured and unsecured creditors are welcome to attend these meetings. You are considered a creditor if:

- The company owes you money for goods and services you supplied

- You made loans to the company

- You are owed products or services you have already paid for

- Are an employee who is owed unpaid wages or entitlements (such as superannuation)

What are the Outcomes of a Voluntary Administration?

The voluntary administration process reduces the possibility of secured creditors pursuing repayment through the company’s secured assets. As mentioned above, at the end of the administration period, the company usually enters into a Deed of Company Arrangement (DOCA) with its creditors.

If the DOCA suggests that the company continue to trade (also known as a ‘trade-on’), the control of the company usually returns to the company directors at the end of the administration period. If the Deed of Company Arrangement is approved by creditors, it will eliminate possible insolvent trading claims.

Some of the main benefits include:

- The company is saved from liquidation and/or deregistration

- Giving the company time to deal with creditors in an orderly manner and prepare a proposal to give the best return to creditors

- An independent practitioner is able to review the company’s affairs and deal with the pressures of creditors

- Reduces the possibility of secured creditors proceeding against the assets of the company

- Eliminate possible insolvent trading claims

The Voluntary Administration Timeline

Suspicion of insolvency

Speak confidentially to an SV Partners expert and arrange meeting

Appointment of voluntary administrator

A voluntary administrator can be appointed by:

• the directors (by resolution of shareholders (often the Director) and in writing)

• a secured creditor (with a security interest in all or substantially all of the company’s property)

• a liquidator (or provisional liquidator)

First meeting of creditors

The voluntary administrator must hold the first meeting of creditors.

At least five business days’ notice of the meeting must be given to creditors.

Creditors can vote at the meeting to:

• Replace the administrator, and/or

• Form a committee of inspection.

Voluntary administrator’s investigation and report

The voluntary administrator must investigate the company’s affairs, potential claims and recoveries available to a Liquidator (see Voidable Transactions) and report to creditors on the alternative options available to the company

Second meeting of creditors – meeting to decide company’s future

The voluntary administrator must hold the meeting to decide the company’s future.

At least five business days’ notice of the meeting must be given to creditors.

Creditors can decide at this meeting to:

- Return the company to the directors’ control; or

- Accept a DOCA (must be signed by the company within 15 business days following the meeting, unless the court allows an extension of time); or

- Put the company into liquidation (this happens immediately, and the administrator usually becomes the liquidator).

How can SV Partners help?

The expert team at SV Partners is highly skilled in assessing a business’ financial position and providing tailored solutions for every situation.

Our role in the voluntary administration process is to trade the company’s business if appropriate, investigate the company’s situation and report to creditors on the company’s affairs.

We understand that voluntary administration not only affects the owners and directors of a business, it can also have a lasting impact on its employees, creditors and shareholders.

We always seek to deliver the best possible outcome for all stakeholders.

If you would like an obligation free consultation, contact us online, or you can reach us through our confidential assist line by calling 1800 246 801.