ASIC have released the June quarter insolvency statistics for the 2013–14 financial year, with statistics showing a rise of 14.6% in companies entering external administration (EXAD).

Corporate appointments totalled 2,308, showing a significant increase compared to 2,014 in the previous March quarter.

Despite the increase in insolvencies from the March quarter 2014, the June quarter 2014 total was 18% lower than the June quarter 2013 total, with 2,815 appointments.

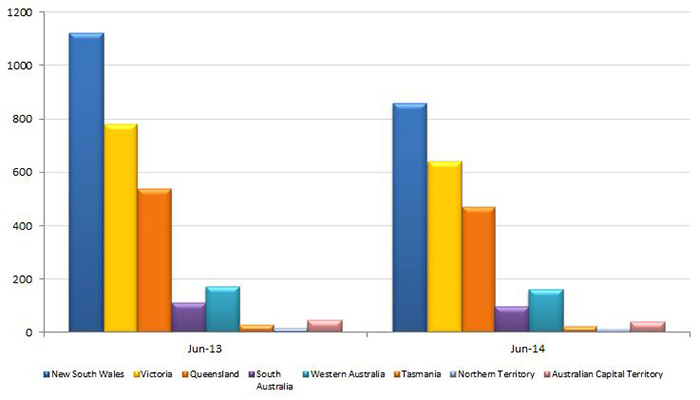

Total Insolvency Appointments by State – Comparative June quarter 2013 and June quarter 2014

Appointment Type

Aside from court liquidations, external administration appointments experienced rises across the board in all types of insolvency, in comparison to the previous quarter.

- Court liquidations – down 6.1%

- Creditor voluntary liquidations – up 24.2%

- Receiverships – up 15.9%

- Voluntary administrations – up 27.8%

Corporate Appointments by Industry – 2013/2014 Financial Year End

Analysis by industry type – quarter ended 30 June 2014

| Top 10 Industries | 9 month period to 31 Mar 2014 | Jun Qtr 2014 | Total | % |

|---|---|---|---|---|

| Other (business & personal) services | 2,363 | 760 | 3,123 | 31.8% |

| Construction | 1,378 | 422 | 1,800 | 18.3% |

| Accommodation & food services | 647 | 172 | 819 | 8.3% |

| Retail trade | 584 | 181 | 765 | 7.8% |

| Transport, postal & warehousing | 361 | 117 | 478 | 4.9% |

| Manufacturing | 343 | 129 | 472 | 4.8% |

| Rental, hiring & real estate services | 237 | 81 | 318 | 3.2% |

| Wholesale trade | 172 | 49 | 221 | 2.3% |

| Agriculture, forestry & fishing | 169 | 49 | 218 | 2.2% |

| Information media & telecommunications | 166 | 56 | 222 | 2.3% |

| Other industries | 830 | 231 | 1,061 | 10.8% |

| Unknown | 264 | 61 | 325 | 3.3% |

| Total | 7,514 | 2,308 | 9,822 | 100% |

Corporate Insolvency by region

Corporate Insolvency appointments rose in all states in comparison to the March 2014 quarter, with the exception of the ACT, which experienced a small decease in appointments (down by 2 appointments or 4.7%).

- New South Wales (up 17.8%)

- Victoria – (up 15.9%)

- Queensland – (up 11.1%)

- South Australia – (up 14.1%)

- Western Australia – (up 0.6%)

- Tasmania – (up 100%)

- Northern Territory (up 85.7%)

If you would like more advice on how SV Partners can assist your clients with corporate insolvency matters, please contact one of our expert advisors on 1800 246 801.

Source – ASIC Insolvency Data ‘Summary Analysis of Insolvency Statistics’

Reference – Series 1, companies entering external administration used as data source.

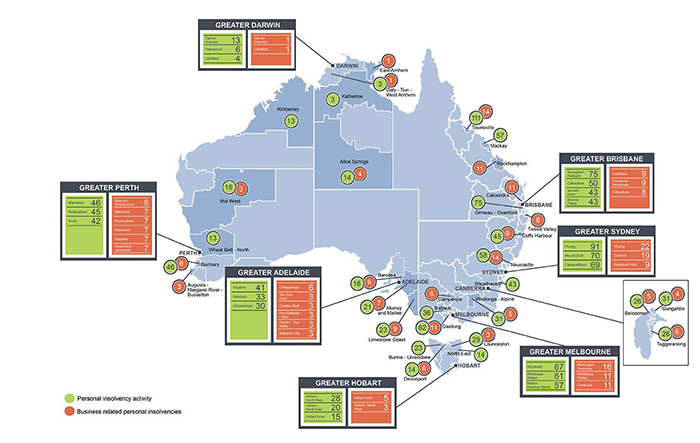

10% Fall in Personal Insolvency for June quarter 2014

AFSA have released their regional statistics for the June quarter 2014, indicating a 10.0% national fall in debtors entering into personal insolvency, compared to the previous March quarter 2014.

New South Wales and Victoria were the states with the greatest decrease in debtors entering personal insolvency with 5.3% and 15.6% respectively, since March quarter 2014.

Click the image to view enlarged map, courtesy of AFSA.

Key statistics by state

Queensland

- The number of debtors entering a personal insolvency in Greater Brisbane fell by 9.4%, with North Lakes being the main contributor to this fall

- The Springfield – Redbank area recorded the highest number of debtors in Brisbane (75 debtors)

- The remaining areas of Queensland decreased by 9.1%, with decreases in 23 regions

New South Wales

- The number of debtors within greater Sydney decreased by 13.6% in the June quarter 2014 compared to the March quarter 2014, with Penrith being the main contributor to the fall

- The highest affected areas were Wyong (91 debtors), Mount Druitt (70 debtors) and Campbelltown (69 debtors)

- The rest of NSW fell by 5.3% in the June quarter 2014 compared to the March quarter 2014

- There were falls in 21 regions, was Griffith – Murrumbidgee (West) showing the highest number of falls

Victoria

- The number of debtors within greater Melbourne decreased by 12.4%, with decreases in 27 regions

- Wyndham (67 debtors), Whittlesea – Wallan (61 debtors) and Melton – Bacchus Marsh (57 debtors) recorded the highest number of debtors in Melbourne

- The regions outside of Melbourne with the highest number of debtors were Geelong (62 debtors), Ballarat (36 debtors) and Wodonga – Alpine (31 debtors).

Further information and statistics including all national results are also available via the AFSA website.

Business Related Personal Insolvency

The number of debtors entering into a business related personal insolvency in the June quarter 2014 fell 18.1% compared to the March quarter 2014 in Australia.

Greater Brisbane was the main contributor, falling 32.3% in the June quarter 2014 compared to the March quarter 2014.

If you would like more advice on how SV Partners can assist your clients with personal insolvency matters, please contact one of our expert advisors on 1800 246 801.