Since the Global Financial Crisis, the economy has been stimulated by the lowering of official interest rates and quantitative easing which has seen an increase in asset prices. Property is the main source of wealth for many families, it must be remembered that housing was the initial cause of the Global Financial Crisis. With the tightening in the lending environment the prospects of a reversal in some asset classes, including house prices appears to be increasing.

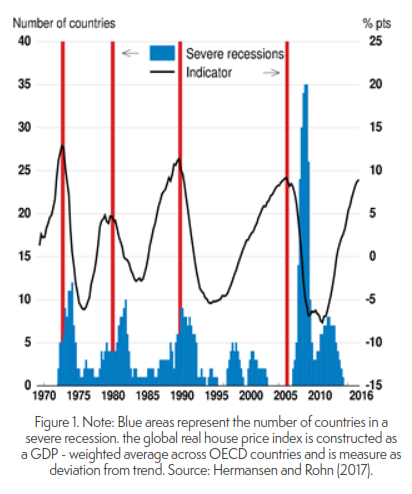

Figure 1, details the historical relationship between global housing process and economic recessions. With history as a guide, when house prices bottom, recessions tend to decline. However, when house prices peak, the number of nations falling into recession almost always increase. There have been many reports that Australian home prices have been falling for more than a year, being led by increasingly steep falls in Sydney with Australia’s largest and most expensive housing market. The downturn has already left its mark on residential construction, leading to large declines in building approvals and development activity, especially for apartment building, along with a decline in employment across the sector.

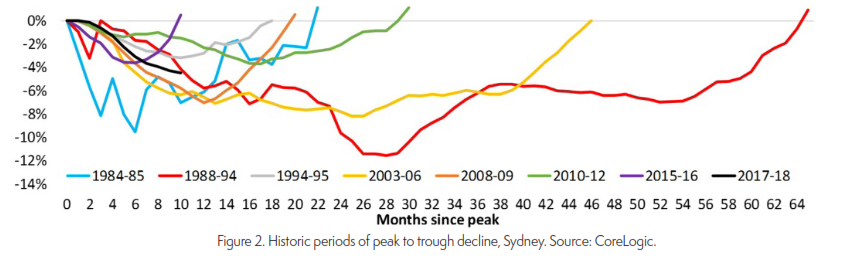

Figure 2, shows the historic periods of peak to trough decline in the Sydney housing market. In the 15 months from July 2017 to September 2018, the housing market has declined 6.2%. At this stage, it has certainly not declined to the levels experienced during the ‘recession we had to have’ in the early 90’s. However that decline in house prices was experienced over a period of 28 months.

We note that changes in household wealth are influential on the level of disposable income saved by household. In recent years the proportion of disposable income saved has been falling which would suggest higher levels of wealth. Further, in an era of weak income growth, households have been encouraged to save less and sustain their spending levels. Now that wealth levels are declining, which the recent weakness in Australia’s sharemarket has also contributed toward, doubt is being cast over the outlook for the largest part of the Australian economy.

According to the Australian Taxation Office (November, 2018), a small business is defined as those businesses with annual turnover of less than $10 million. There are around 4 million small businesses in Australia which account for 99 per cent of all businesses. They employ nearly 5.6 million Australians and contribute approximately $380 billion to the economy.

Access to finance for small business is important because they generate employment, drive innovation and boost competition in markets. Our experience is that a large number of small businesses rely upon finance which is secured by the owners personal property to fund their business. So, with declining property prices, not to mentioned the outcomes from the recent Royal Commission into the banking industry, access to finance for small business has become more difficult and without same, some business will be forced to seek alternative sources of funding from lenders or investors which comes at a higher price, which could limit the growth of small business.

Declining asset values could also resulting in businesses inadvertently breach of lending covenants for want of lending ratios which may require action to be taken to reduce the lending exposure. It is not always possible for small businesses to address such issues in a timely manner which could lead to a forced sale of the business, or worse, business failure. Given the above, it can be said that declining housing prices can be a lead indicator of economic recession. A close eye will need to be kept on the property market to see if the downward trend continues over a prolonged period of time which could lead to an economic recession.

[vc_empty_space height=”30px”][vc_row css_animation=”” row_type=”row” use_row_as_full_screen_section=”no” type=”full_width” angled_section=”no” text_align=”center” background_image_as_pattern=”without_pattern” padding_top=”5%” padding_bottom=”5%” css=”.vc_custom_1505178040953{border-top-width: 1px !important;border-top-color: #e6e7e8 !important;border-top-style: none !important;}”][vc_column][vc_column_text css=”.vc_custom_1505177851986{padding-top: 5% !important;padding-bottom: 5% !important;}”]

Are you concerned about your financial position?

Contact us now for an obligation free consultation on

1800 246 801

[popup_trigger id=”2181″ tag=”button” classes=”sendEmailBtn”]SEND US A SECURE EMAIL[/popup_trigger]

[/vc_column_text][/vc_column][/vc_row]