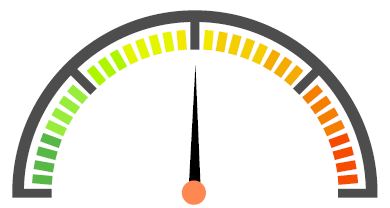

Types of risk

High To Severe

Risk Bands 1 – 3

Average to Moderate

Risk Bands 4 – 5

Minimal to Low

Risk Bands 6 – 8

What makes up the risk score?

Key contributing factors (not limited to) that frame a risk score are as follows:

- The type and frequency of credit enquiries

- The time since a business/company made or changed its registration

- Credit activities including credit enquiries or adverse information of the business proprietor

- Existence of default information on a company file

- Credit source enquiries that a company makes may impact its trade history

- Serious adverse event information recorded such as a previous external administration or other serious adverse events on file

- Industry based enquiry patterns

- Director information and credit activity of a company director such as credit enquiries or adverse events

How we can minimise your risk

Action: Stabilisation

Likelihood: Wind up notice, court writ, payment default, mercantile enquiry

Immediate Future:

Rapid assessment, quick win strategies, full situational analysis to prioritise action plans

Action: Business Improvement

Likelihood: Potential to slip into high risk if no immediate action taken

Immediate Future:

Address operational inefficiencies, missed market opportunities, people/tech issues, work on add value options

Action: Efficiency & Value Enhancement

Likelihood: Overcome challenges & grow/succeed

Immediate Future:

Further enhance operational efficiencies, growth in new markets/locations/services. Potential M&As, profitability focus, succession planning