Why would an MVL be used?

- Simplification of a group structure wherein the more subsidiary companies the greater the compliance costs.

- The reason for the company’s existence is no longer relevant, or the company has achieved its purpose (such as in the construction industry)

- A family company has outlived the first and perhaps even second-generation founders and the present shareholders no longer wish to be in business together or want access to any shareholders’ entitlements they may have.

- It provides a measure of security, as a Liquidator is appointed if the company is revived (for example, to answer historical insurance claims).

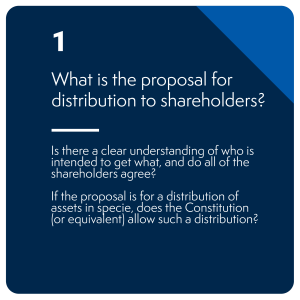

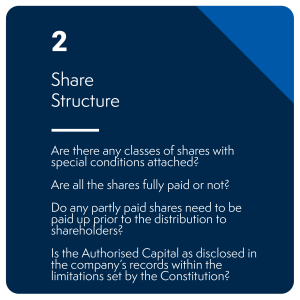

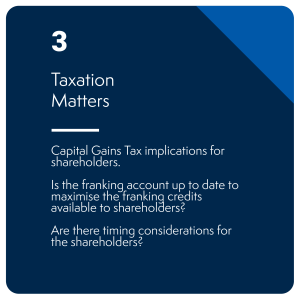

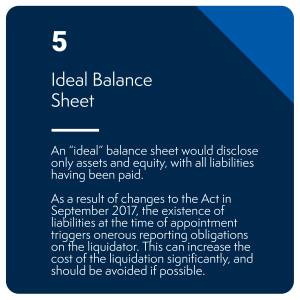

Considerations before commencing an MVL

The MVL Process

Upon the appointment, the liquidator will:

- notify the ATO and other statutory bodies of the appointment of the liquidator, and advertise for any claims against the company.

- identify and take control of all of the company’s assets.

- instruct the company’s tax accountant to prepare the final accounts and tax lodgements up to the date of liquidation and ensure the final tax payment is made.

- seek clearance from the ATO to distribute the company’s assets in accordance with Section 260-45 of the Tax Administration Act 1953.

- lodge an account of the liquidation with ASIC. The company is deregistered 3 months after the lodgement of this account.