Dealing with outstanding tax debt is a situation many businesses find themselves facing and remains an ongoing issue for the ATO. In 2018-19, small business accounted for $16.5 billion in collectable debt at the ATO, an increase of $2.6 billion over 2 years, with many businesses facing short term cash flow problems which prevented them from meeting their obligations.

The ATO have a number of solutions in place to assist small businesses who are struggling to pay their tax bill on time, including tailored payment plans. Over the 2018-19 period, over 800,000 payment plans were put in place to support small businesses with their tax debt, assisting them to get back on track.

What happens if I don’t pay?

Communication is extremely important and businesses are urged to engage early on with ATO, maintaining regular contact to ensure they do not fall further behind if struggling to meet their obligations. Failure to heed the warnings and not address ongoing issues in regards to paying owed amounts on time can result in serious consequences which could further adversely affect the ongoing operation of a business.

These include:

- Being charged interest on unpaid amounts

- Use of future refunds or credits to pay amounts owed

- Certain debts referred to external collection agencies

- Garnishee Notices

- Direction to pay Super Guarantee Charge (SGC)

- Director Penalty Notice (DPN)

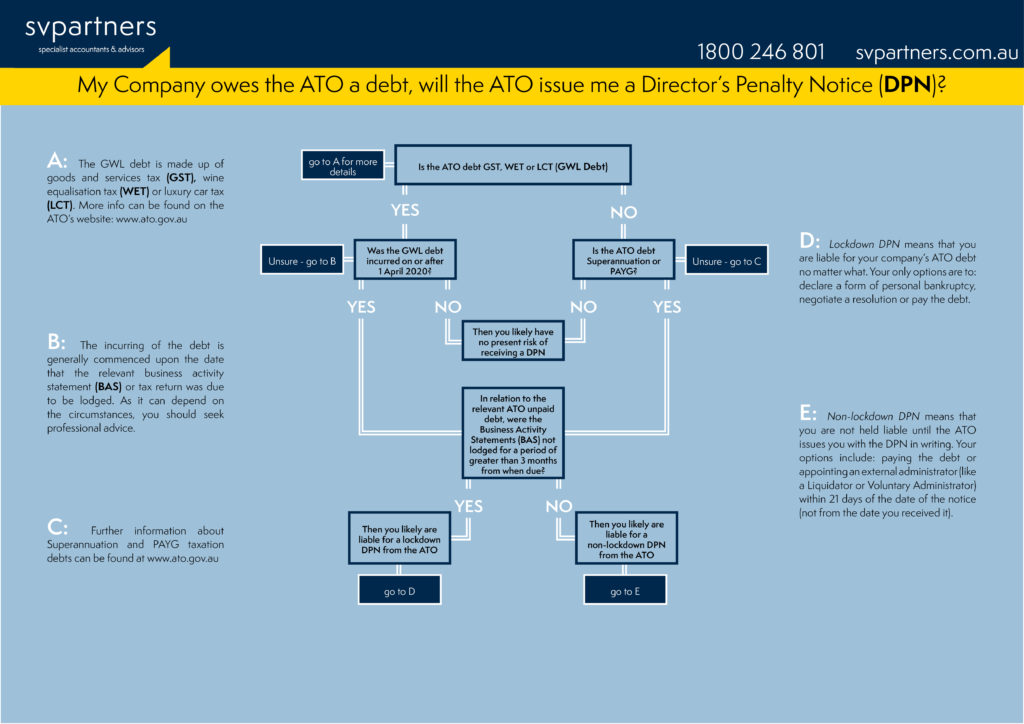

What is a Director Penalty Notice (DPN)?

A Director Penalty Notice is issued by the ATO to a Director for failure to meet the PAYG and Superannuation obligations of their Company, holding the Director personally accountable for these liabilities. Essentially, the DPN allows the ATO to start legal proceedings against the Director to recover the penalty.

With the recent passing and assent of The Treasury Laws Amendment (Combating Illegal Phoenixing) Bill 2019 (Phoenixing Bill), broadening the Director Penalty Notice system to include a company’s GST liabilities, it’s more important than ever for Directors to ensure they meet their obligations to avoid being issued with a Director’s Penalty Notice.

The included infographic should be used as a reference in identifying the likelihood of the ATO issuing a Director’s Penalty Notice for failure to meet tax obligations.

Infographic content provided by Matthew Hudson, SV Partners Brisbane

Infographic content provided by Matthew Hudson, SV Partners Brisbane