The SBR regime was introduced in January 2021 to provide small businesses with a cost-effective and streamlined alternative to traditional external administration, while keeping directors in control of the company during the restructuring phase.

ASIC reviewed the Small Business Restructuring (SBR) process for appointments between 1 July 2022 to 31 December 2024, examining a total of 3,388 SBR appointments. To summarise the report:

“After a slow start, the recent growth of SBRs and other data in our report shows that the SBR regime is starting to deliver on the intended policy objective of reducing the complexity and costs involved in insolvency processes for small businesses and ultimately helping them to survive..”

The process involves two stages:

- Appointment of a restructuring practitioner (usually a registered liquidator); and

- Proposal of a restructuring plan to creditors within 20 business days.

If creditors accept the plan, the business continues under a legally binding arrangement to repay a portion of its debts — often avoiding liquidation. Learn more about the SBR process here.

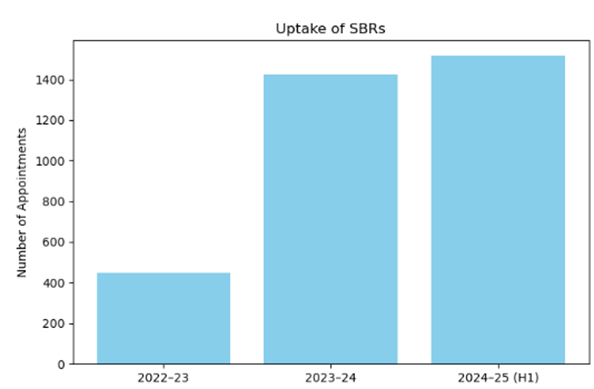

When the SBR regime was introduced 2021, it had a notably low number of appointments in the first year however, the uptake in appointments has been very positive since. It has grown significantly from 448 in 2022–23 to 1,425 in 2023–24, with 1,515 already recorded in the first half of 2024–25.

Number of SBR appointments by financial year

ASIC are continuing to review the new regime’s effectiveness and as a result had issued a report outlining their findings (Media release 25-111). Their review of the SBR process and a copy of their report can be found here.

The Key Insights from ASIC’s Report included the following:

- Outcomes of SBR Appointments:

- 87% of proposed plans were approved by creditors.

- 92% of finalised plans were completed.

- 93% of companies with completed plans remained registered as of April 2025.

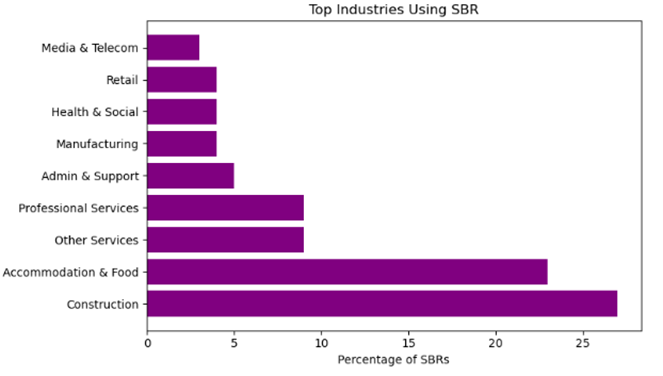

- Sector concentration:

- Nearly 50% of all SBRs were concentrated in the Construction (27%) and Accommodation & Food Services (23%) sectors.

- SBR Totals by state: NSW (40%), QLD (24%) and Vic (23%).

- Creditor support: Of the 3,388 SBR appointments, 2,820 successfully transitioned into restructuring plans. SBR appointment numbers are expected to be over 3,000 in the 2024-25 financial year.

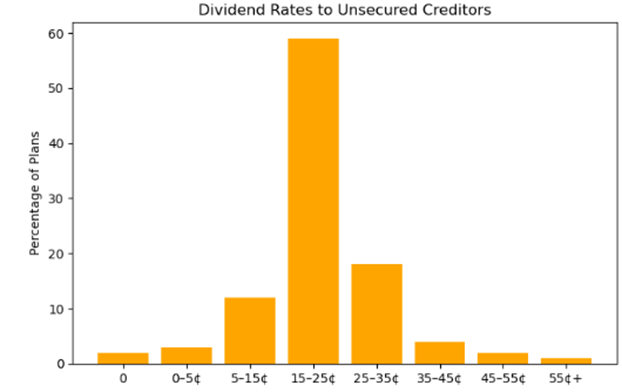

- Return to creditors: Over $101 million was returned to unsecured creditors, with the ATO receiving approximately $88 million — a significant vote of confidence in the regime. The average median dividend to creditors was 20 cents in the dollar. The ATO was a creditor in at least 93% of the completed plans.

- Practitioner fees: The median remuneration for restructuring practitioners remained steady at around $22,000.

Some examples of our experience with SBRs include:

Has the Small Business Restructuring Process Been a Success?

Small Business Restructures in the Wild

Australian Taxation Office

Since the regime had been introduced, the ATO had a positive response to the new regime as it provided an opportunity for those entities to bring their compliance up to date (as a requirement) and recoup outstanding tax owed, where, in most cases, they would have received little to no dividend in a liquidation scenario. In 2023, the ATO were quoted as accepting 92% of all plans.

Subsequently, approval rates have receded largely due to changing internal ATO policy requirements, including:

- Company and Director tax compliance history;

- Related party loans increased as tax balances rose;

- Where matters require further investigation.

Conversely, directors and advisors of companies have utilised the SBR regime as an effective insolvency appointment to deal with Director Penalty Notices.

SV Partners’ Perspective

The introduction of the SBR regime has been largely positive. It provides a type of appointment that is far more conducive to providing a return to creditors, where ordinarily, in a voluntary liquidation scenario, it would not have provided any return at all.

The ASIC report indicates that numerous companies which have completed the SBR process continue to remain registered today, suggesting that they are still actively trading.

With offices in all major capital cities and a dedicated team of over 150 professionals, SV Partners has a deep understanding of the SBR process and its transformative potential. Our experience across a diverse client base confirms the ASIC report’s findings that the SBR regime is working.

We’ve supported businesses across numbers sectors including many across hospitality and construction through the restructuring process — helping owners stabilise operations, retain employees, and restore creditor confidence. The ability to act early and propose a practical plan under the guidance of a registered restructuring practitioner has been key to many successful outcomes.

Moreover, our team ensures transparency, compliance, and creditor engagement throughout the process, which we see as essential to protecting the regime’s integrity and long-term viability.

The Small Business Restructuring regime is no longer a new or niche option where it is now a credible, proven pathway to turnaround.

To learn more about the SBR process or speak to a restructuring expert, you can also explore our full range of financial advisory services or call us on 1800 246 801.

Article written by Adam Thorpe (Associate Director) - Brisbane