It is undeniable that the ATO has broad powers to collect taxation debts and enforce compliance on taxpayers. Where the ATO believes that stronger recovery action is required against a taxpayer, it may elect to issue garnishee notices to persons or businesses that may hold money for that taxpayer. It is difficult however to grasp the volume of garnishee notices issued each year, as these figures are not reported in the ATO’s annual report.

The most recent data on this issue was produced from the Inspector General’s ‘Management of Tax Disputes’ Report, dated 20 July 2015 (the Report). For instance, the Report provides that for the 3 year period ending 30 June 2014:

- the ATO had issued 207,223 garnishee notices; approximately 8% of which were issued to SMEs; and

- approximately 2.09% of companies issued with a garnishee notice ended up insolvent.

In an insolvency context, based on the Inspector General’s numbers, approximately 1,443 taxpayers per year become insolvent as a result of the issue of garnishee notices. Therefore, it is important for Practitioners to be aware of how garnishee notices should be treated once a company goes into liquidation.

Pre-liquidation taxation liabilities

Since the High Court decision in Bruton Holdings Pty Limited (in liquidation) v Commissioner of Taxation HCA 32, the position has been clear that the ATO cannot issue a garnishee notice for pre-liquidation taxation liabilities, where the company is already in liquidation.

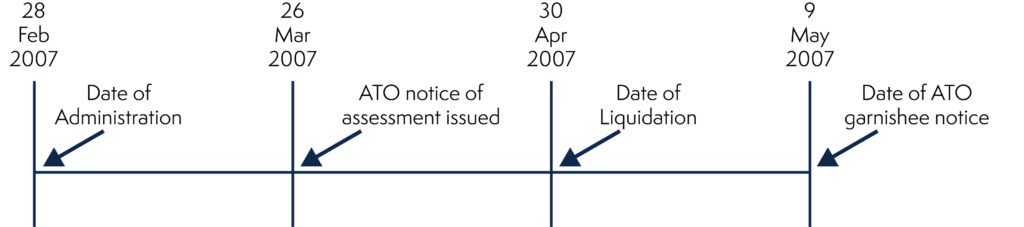

Diagrammatically, the series of events in Bruton were:

The High Court in holding that the ATO could not issue garnishee notices for pre-liquidation taxation liabilities from a company already in liquidation relied on the following:

- The garnishee notice had the effect of attaching to the property of the company and thereby fell within the meaning of “attachment”, as was found within the Corporations Act 2001 (Cth) (the Act); and

- Section 500(1) of the Act deemed all “attachments” against the property of the company already in liquidation as void.

Post-liquidation taxation liabilities

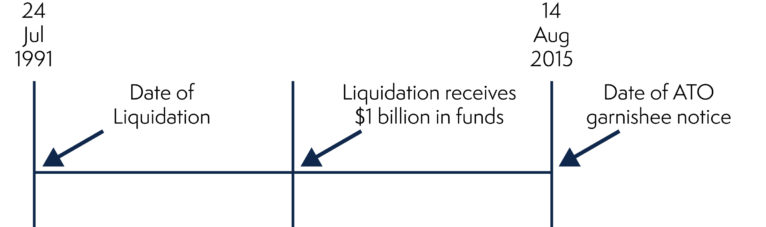

Consider the scenario where a Liquidator, in performing their duties to realise the assets of the company to disperse to creditors, incurs taxation liabilities (like GST, PAYG or income tax) and is subsequently issued with a garnishee notice by the ATO. The garnishee notice requires the immediate disbursement of funds held in the liquidation bank account to the ATO. Well, this is what happened in the recent decision of Bell Group Limited (In Liq) v Deputy Commissioner of Taxation FCA 1056. In this case, the ATO issued a garnishee notice on the National Australia Bank Limited (the NAB) requiring the NAB to transfer more than $298 million to the ATO from funds held for the company in liquidation (these funds totalled more than $300 million).

The key difference to Bruton was that the taxation liabilities arose after the Liquidators appointment and were liable to be paid in full by the Liquidator to the ATO before any other disbursements could be made. See below:

The Federal Court of Australia in September 2015 held that the ATO could also not issue garnishee notices for post-liquidation taxation liabilities from a company already in liquidation. The Federal Court said that:

- The garnishee notice had the effect of attaching to the property of the company and thereby fell within the meaning of “attachment”, as was found within the Act;

- Sections 468(4) and 500(1) of the Act deemed all “attachments” against the property of the company already in liquidation as void; and

- The power conferred by s 260-5 of Schedule 1 to the Taxation Administration Act 1953 (Cth) is not available where the company is already in liquidation.

Justice Wigney went on to say that:

“The problem with the Commissioner’s construction is that it ignores the word “attachable” in s 254(1)(h) of the ITAA36. The remedies against property in the control or possession of an agent or trustee that are preserved or conferred on the Commissioner by s 254(1)(h) are expressly limited to remedies against “attachable” property. The word “attachable” is not used in the case of the property of other taxpayers. The property under the control of a liquidator is therefore not treated in the same way as the property of any other taxpayer. The property of a company being wound up that is in the control or possession of a liquidator is not “attachable property” because, by reason of ss 468(4) and 500(1) of the Corporations Act, any attachment against such property is void.”

Takeaway

At this time, it is clear that that ATO cannot issue garnishee notices on companies that are already in liquidation for both:

- Pre-liquidation taxation liabilities; and

- Post appointment taxation liabilities.

If you have any questions about the above article and how this may impact you or your clients, please feel free to contact one of our Expert Advisors on 1800 246 801.

Article written by Matthew Hudson, SV Voidables Queensland