Whilst Australia continues to manage “the curve”, this has come at a significant cost to business and the economy as a whole. No one knows when it will end and what the outcome will be economically.

Now is the time for business owners to be making post-pandemic plans to deal with the looming “debt bubble”. The business survival tips provided below is aimed at assisting accountants and business advisors to proactively engage with clients to plan for life after the stimulus measures cease.Temporary Insolvency Relief Measures

The following summarises some of the insolvency temporary relief measures put in place by the Federal Government:

- Coronavirus Economic Response Package Omnibus Act 2020

- Relief Period – 25 March 2020 to 24 September 2020

- Minimum debt to issue a Bankruptcy Notice or Statutory Demand – $20,000

- Time to comply with a Bankruptcy Notice or Statutory Demand – 6 months

- No insolvent trading against Directors for debts incurred during the Relief Period provided the insolvency incurred during that time.

Insolvent Trading Protection

Company directors will not be held liable for insolvent trading during the period March to September however there are conditions to these protections.

They include that:

A) The company must have been solvent before March 2020 and only become insolvent as a consequence of the crisis; and

B) The company must enter external administration before the protections expir Obviously this will only be necessary if the company is still insolvent at that time.

Personal Liability for Company Debts

Whilst the stimulus measures have provided some BAS relief, directors of companies continue to be held personally liable for unpaid PAYG and GST that is not reported within 3 months of the due date and superannuation not reported by the due date.

Deferred Payments

Many business owners have suspended payments to financiers, landlords and trade creditors. Doing so will obviously assist cash flow in the short term, but many debts such as business loans, will still attract interest during this period and will need to be paid when the deferral period ceases.

ATO, Banks and Landlords

There is in general an understanding of businesses’ predicament from these categories of creditors. The ATO and banks have generally worked with business to provide deferment of debt repayment. Legislation has dealt with rental payments and debts owing to landlords.

Ordinarily, these creditors would require repayment in full. An informal or formal compromise of these creditors in the current climate is more likely now than in a post-pandemic era.

Constructive Suggestions

- Help clients assess the viability of their business and try to be impartial and logical. Jobkeeper will tie businesses over until potentially March 28 and beyond (subject to qualifying), but when that assistance ends, many businesses will no longer be viable. A tough conversation now will likely be appreciated by clients in the long term;

- Start to develop a turnaround plan now – what needs to change in the operations of the business to make it profitable. There may be only a few changes that need to be made to a business to restore or increase profitability;

- Start negotiating repayment plans now. Promise long and (hopefully) deliver short by proposing the commencement of repayments in the first quarter of 2021;

- Actively engage with financiers, suppliers, landlords and the ATO to negotiate repayment plans to gain the business sufficient time to implement the turnaround plan. Any payment plan needs to be conservative to ensure that the cash flow of the business isn’t overwhelmed when operations return to normal. Most creditors will be expecting such requests and many credit managers are already becoming wary of debtors using the COVID-19 virus as an excuse for non-repayment of debts incurred well before the impact of the virus became apparent;

- Utilise the stimulus measures on offer; and

- Try to avoid accessing personal resources to support the cash flow of a business that isn’t presently viable without first assessing whether the business can be viable once again.

Now is the time to undertake this process. Creditors, including the ATO, expect business owners to be proactive in the management of their business and will be more likely to entertain repayment plans, debt compromises etc now than when business returns to “normal”.

- Continuing losses

- Overdue taxes and superannuation

- Poor relationship with bankers and inability to borrow further

- No access to alternative finance

- Inability to raise further equity

- Suppliers stopping accounts, changing to COD or demanding special payment arrangements before resuming supply

- Creditors remaining unpaid outside normal industry trading terms

- Dishonoured payments

- Legal letters of demand, summonses, judgments or warrants issued to recover outstanding debts

- Inability to produce accurate financial information

- Less general management control of business

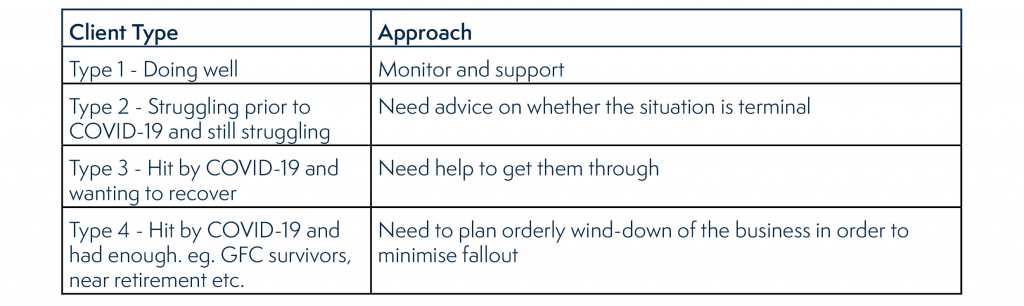

We’ve identified four types of clients which you are likely to encounter during this time. Each will require a tailored approach to guide them through their unique set of challenges.

Summary

Summary

With the exception of certain stimulus measures offered by the Federal Government, there is no free ride in business. Owners should expect to repay fixed overheads incurred whilst their business is not operating at capacity or in hibernation and should consider the impact this will have on future cash flow.

Business should be considering debt restructuring and compromise measures now in order to give them the best chance to survive after government support is withdrawn.

Useful Links:

- Government Insolvency Relief Fact Sheet

- SV Partners – What’s the Solution Fact Sheet

- SV Partners – Solutions for Businesses

- SV Partners – Solutions for Individuals

Article written by David Stimpson – Executive Director, Brisbane