A recent Federal Court case (1) has found that the liquidator of a company after a failed Deed of Company Arrangement (DOCA) may recover payments made to the ATO, on tax debts accrued during the DOCA period, as unfair preferences (pursuant to ss 588FA and 588FE(2B) of the Corporations Act 2001 (Cth) (the Act)).

Despite not being directly dealt with in this new case, what this could mean for directors of companies proposing a DOCA in a Voluntary Administration (VA) is that if the DOCA fails and the Liquidator is successful in recovering these payments from the ATO, the director could be personally liable to (in effect) reimburse the ATO (pursuant to s 588FGA of the Act). F.A.F.G.A – meaning 588FA plus 588FGA.

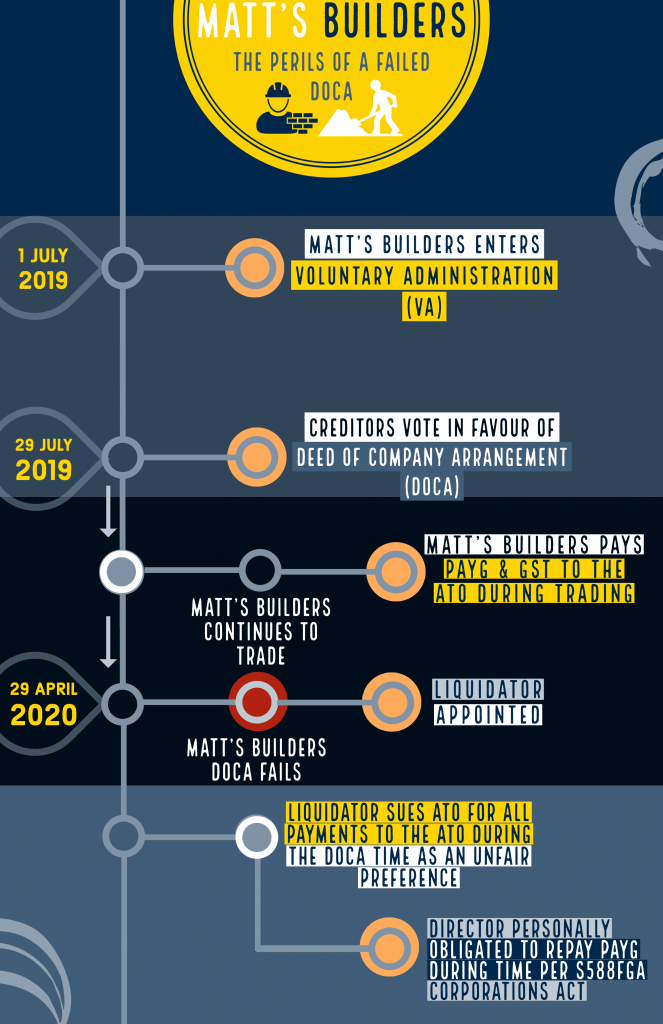

To keep this simple, let’s take the fictitious company Matt’s Builders Pty Ltd, and its entrepreneurial director Matt Jones, as an example.

Matt’s Builders has fallen on hard times due to COVID-19 and knows that it can’t meet the minimum financial requirements to sustain its building licence with the QBCC. Luckily, Matt knows that his company also has a solid property management business that it can fall back on; just as long as it can restructure its affairs.

Matt’s Builders appoints a Voluntary Administrator and proposes a DOCA that offers to pay creditors 50 cents in the dollar over a 12 month period as long as it can continue to trade its property management business.

Creditors of Matt’s Builders vote in favour of the proposed DOCA, mainly because it represents a materially better outcome than if Matt’s Builders was placed into Liquidation.

Nine months into the DOCA, and the property management business is not going so well. The outbreak of COVID-19 and the effects it has had on the Australian economy has meant that many people are out of jobs, and can’t pay their rent.

Matt’s Builders is forced to terminate the DOCA and Liquidators are appointed in their place. The Liquidators work out that Matt’s Builders has paid about $1 million to the ATO DURING this 9 month period for all sorts of taxes – for instance $200k for GST, $500k for PAYG and about $300k for income tax.

So the Liquidator pursues the ATO in Court for unfair preference payments totalling $1m, on the basis that the payments were made “by, or under the authority of” (2) Matt and Matt’s Builders. This is where the Federal Court found that the ATO was liable to repay the Liquidator.

What Matt needs to worry about is that in any voidable transaction proceedings against the ATO (including unfair preferences), Matt may need to indemnify the ATO for Prescribed Amounts. These Prescribed Amounts include the $500k PAYG, but not likely the GST or income tax liabilities.

Matt may rely on the defences found in s 588FGB of the Act, but he should seek assistance from his appropriately qualified lawyer as soon as possible.

Therefore, before proposing a DOCA, you should seek expert advice from an insolvency professional who may be able to help mitigate your risk of the above events happening to you. SV Partners team is here to assist on 1800 246 801.

Article written by Matthew Hudson

Senior Manager – SV Partners Brisbane

(1) Yeo, in the matter of Ready Kit Cabinets Pty Ltd (in liq) v Deputy Commissioner of Taxation FCA 632.

(2) Section 588FE(2B) of the Act wording.