When is a company eligible to apply for the Simplified Liquidation process?

Simplified liquidation only applies to companies that are being wound up via CVL, where the winding-up occurs on or after the 1st of January, 2021. In order for a company to be eligible for simplified liquidation, the company must:

- Be unable to pay its debts in full within 12 months after the liquidation commences;

- Have total liabilities of less than $1 million (not including contingent liabilities);

- Ensure all its tax lodgements are up to date;

- The director(s) of the company (including people who have been directors up to 12 months prior to the appointment of a liquidator) must not have used the simplified liquidation or restructuring process in the preceding 7 years.

In addition to the above, within 5 business days of the liquidation commencing, the directors must provide a report on the company’s affairs and a declaration that they believe the company meets the simplified liquidation eligibility criteria.

Eligibility for simplified liquidation is measured using a strict test that critically evaluates businesses prior to commencing liquidation. To ensure your company passes the eligibility test, we encourage you to reach out to SV Partners’ highly qualified team to assist with declaration and testing.

How does a Simplified Liquidation differ from a Creditors Voluntary Liquidation?

How a Simplified Liquidation commences

When a company is placed into a CVL, the liquidator can choose to adopt the simplified liquidation process if they believe the company is eligible.

At least 10 business days before adopting simplified liquidation, the liquidator must give all company members and creditors notice of their intention to do so. Simplified liquidation cannot be used if, before the 10 business days have expired, 25% or more of the creditors request the liquidator not use simple liquidation.

If the process is not adopted within the first 20 business days of the liquidation commencing, it cannot be used thereafter.

What are the expected outcomes of Simplified Liquidation?

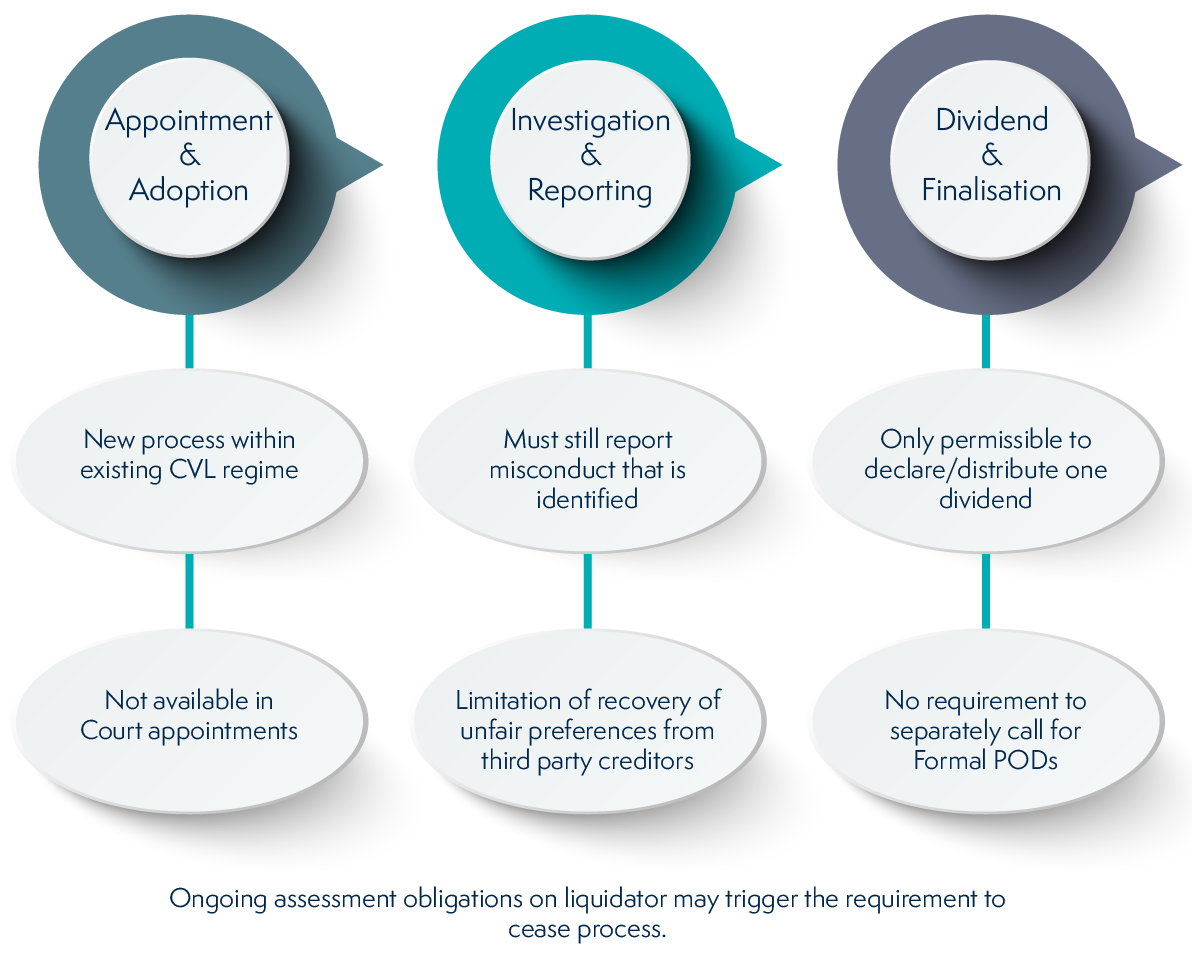

Simplified liquidation follows much the same process as standard liquidation. The company’s assets are realised, investigations are completed and distributions are made to creditors. Afterwards, the liquidator will apply to ASIC to deregister the company. Once a business has been deregistered, creditors will no longer have any claim against the company.

The diagram to the left illustrates what the expected process and outcomes of the simplified liquidation could look like for your company.

Our Approach

Contact us to speak confidentially about your situation

We’ll arrange a meeting with you to discuss all your options

Our team will work with you throughout the process, ensuring the best possible outcome

How Liquidation Price is Calculated

The liquidation price is the net value of a company’s tangible assets if it were to be wound up in liquidation. Liquidation price is calculated by subtracting the value of a company’s liabilities from its tangible assets. This gives the estimated value that can be recovered from a company during liquidation.

Liquidation price is only a guide. It reflects the value of tangible assets that could be sold on short notice during liquidation proceedings. Because Liquidators are often trying to recover as much money as possible in a short period of time, tangible assets are typically sold below market value.

For that reason, the liquidation price is often significantly less than the company’s market value, which includes intangible assets such as goodwill and intellectual property.

How can SV Partners help?

SV Partners work with accountants, legal advisors, financial institutions, related professionals and their clients, assisting with a broad range of insolvency processes. Our aim is always to achieve the best possible outcome for all stakeholders. Our role as Liquidators in Simplified Liquidation is to act as an independent third party and ensure the process is administered according to the relevant legislation. The SV Partners team are highly qualified and have worked with businesses from a wide variety of industries. Our extensive knowledge of business and the impact of insolvency drives us to help companies navigate financial distress and get back on track.

For more information about the Simple Liquidation process, voluntary administration or business turnaround services, contact us for a confidential consultation with one of our experts by calling 1800 246 801.